Выполнить задания: Section A (Total marks=35 marks) Exchange Rate Question 1: (20 marks) What is the "balance of payments account" of a country? Describe the 3 parts of the account and list the items recorded in each part. Download and print the current A/C balance as a % of GDP for the period... №1400844

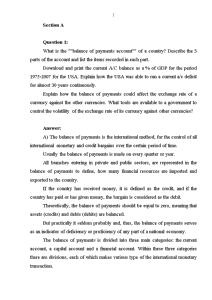

Тема полностью: Выполнить задания: Section A (Total marks=35 marks) Exchange Rate Question 1: (20 marks) What is the "balance of payments account" of a country? Describe the 3 parts of the account and list the items recorded in each part. Download and print the current A/C balance as a % of GDP for the period 1975-2007 for the USA. Explain how the USA was able to run a current a/c deficit for almost 30 years continuously. Explain how the balance of payments could affect the exchange rate of a currency against the other currencies. What tools are available to a government to control the volatility of the exchange rate of its currency against other currencies? Question 2: (15 marks) Explain the Purchasing Power Party (PPP) and Interest Rate Party (IRP) of exchange rates. Using the interest rate party, express the forward exchange rate of £ against $ in t years time, as a function of spot exchange rate and the interest rates of the two countries. The current exchange rate between £ and $ is given as £1 = $ 1.70. The annual interest rate are 3% in the UK and 1% in the USA. You may assume that the rates will remain unchanged for the next few years. Calculate the future exchange rate of £ against $ I) after 1 year II) after 3 years III) after 6 months. State your assumptions. The USE increases the interest rate suddenly to 2% p.a. What affect will it have on the £ vs $ exchange rate in the short term and in the long term? Explain your answer. Section B Applying Strategic Planning to Banking Question 1: Retail and Investment Banking (15 marks) Assume that you are employer by a medium - sized European Banking Group and you are assigned to the team is scheduled for next month. Your senior has asked you to identify the issues that could be raised in the maating next month. He wants you to review the Current European Banking environment and Develop Strategies that will promote growth, improve performance and increase profitability. He wants you to consider domestic as well as international perspectives. Draft a report which will meet this requirement and specification. Show clear headings and use paragraphs to distinguish important points. (15 marks) Section C Regulation (50 marks) Question 1: Regulation of Banks and Financial Markets (general) The regulation of financial markets in general and banks in particular has always been a controversial issue. The banking sector is undoubtedly the most heavily regulated sector in many countries. Inspite of these tight regulatory systems the world has witnessed many financial crises and major bank failures. Describe the rationale for regulating bank and financial markets. Identify the different types of regulation and discuss the limitations of regulation. (25 mars) Question 2: Regulation of Banking and Financial Services Industry (UK) The regulatory system of the UK banking and financial services industry has changed dramatically since the 'Big Bang' in 1986 Describe the major changes that have taken place in the regulator environment since then. Also describe the current system in detail. What are the likely changes that could take place in the system in the next five years? (25 marks)

Артикул: 1400844

- Тип работы: Курсовая работа MBA

- Предмет: Английский язык

- Уникальность: 97% (Антиплагиат.ВУЗ)

- Разместил(-а): 103 Егор в 2009 году

- Количество страниц: 23

- Формат файла: doc

1 470p.

Материалы, размещаемые в каталоге, с согласия автора, могут использоваться только в качестве дополнительного инструмента для решения имеющихся у вас задач,

сбора информации и источников, содержащих стороннее мнение по вопросу, его оценку, но не являются готовым решением.

Пользователь вправе по собственному усмотрению перерабатывать материалы, создавать производные произведения,

соглашаться или не соглашаться с выводами, предложенными автором, с его позицией.

| Тема: | Выполнить задания: Section A (Total marks=35 marks) Exchange Rate Question 1: (20 marks) What is the "balance of payments account" of a country? Describe the 3 parts of the account and list the items recorded in each part. Download and print the current A/C balance as a % of GDP for the period 1975-2007 for the USA. Explain how the USA was able to run a current a/c deficit for almost 30 years continuously. Explain how the balance of payments could affect the exchange rate of a currency against the other currencies. What tools are available to a government to control the volatility of the exchange rate of its currency against other currencies? Question 2: (15 marks) Explain the Purchasing Power Party (PPP) and Interest Rate Party (IRP) of exchange rates. Using the interest rate party, express the forward exchange rate of £ against $ in t years time, as a function of spot exchange rate and the interest rates of the two countries. The current exchange rate between £ and $ is given as £1 = $ 1.70. The annual interest rate are 3% in the UK and 1% in the USA. You may assume that the rates will remain unchanged for the next few years. Calculate the future exchange rate of £ against $ I) after 1 year II) after 3 years III) after 6 months. State your assumptions. The USE increases the interest rate suddenly to 2% p.a. What affect will it have on the £ vs $ exchange rate in the short term and in the long term? Explain your answer. Section B Applying Strategic Planning to Banking Question 1: Retail and Investment Banking (15 marks) Assume that you are employer by a medium - sized European Banking Group and you are assigned to the team is scheduled for next month. Your senior has asked you to identify the issues that could be raised in the maating next month. He wants you to review the Current European Banking environment and Develop Strategies that will promote growth, improve performance and increase profitability. He wants you to consider domestic as well as international perspectives. Draft a report which will meet this requirement and specification. Show clear headings and use paragraphs to distinguish important points. (15 marks) Section C Regulation (50 marks) Question 1: Regulation of Banks and Financial Markets (general) The regulation of financial markets in general and banks in particular has always been a controversial issue. The banking sector is undoubtedly the most heavily regulated sector in many countries. Inspite of these tight regulatory systems the world has witnessed many financial crises and major bank failures. Describe the rationale for regulating bank and financial markets. Identify the different types of regulation and discuss the limitations of regulation. (25 mars) Question 2: Regulation of Banking and Financial Services Industry (UK) The regulatory system of the UK banking and financial services industry has changed dramatically since the 'Big Bang' in 1986 Describe the major changes that have taken place in the regulator environment since then. Also describe the current system in detail. What are the likely changes that could take place in the system in the next five years? (25 marks) |

| Артикул: | 1400844 |

| Дата написания: | 20.09.2009 |

| Тип работы: | Курсовая работа MBA |

| Предмет: | Английский язык |

| Оригинальность: | Антиплагиат.ВУЗ — 97% |

| Количество страниц: | 23 |

Скрин проверки АП.ВУЗ приложен на последней странице.

Курсовая работа MBA

Курсовая работа MBA

Выполнить задания: Section A (Total marks=35 marks) Exchange Rate Question 1: (20 marks) What is the "balance of payments account" of a country? Describe the 3 parts of the account and list the items recorded in each part. Download and print the current A/C balance as a % of GDP for the period..., Курсовая работа MBA по предмету Английский язык - список файлов, которые будут доступны после покупки:

Пролистайте готовую работу "Выполнить задания: Section A (Total marks=35 marks) Exchange Rate Question 1: (20 marks) What is the "balance of payments account" of a country? Describe the 3 parts of the account and list the items recorded in each part. Download and print the current A/C balance as a % of GDP for the period..." и убедитесь в ее качестве перед тем как купить:

После покупки артикул автоматически будет удален с сайта до 23.03.2025

Посмотреть остальные страницы ▼

Уникальность курсовой работы MBA — 97% (оригинальный текст + цитирования, без учета списка литературы и приложений), приведена по системе Антиплагиат.ВУЗ на момент её написания и могла со временем снизиться. Мы понимаем, что это важно для вас, поэтому сразу после оплаты вы сможете бесплатно поднять её. При этом текст и форматирование в работе останутся прежними.

Качество готовой работы "Выполнить задания: Section A (Total marks=35 marks) Exchange Rate Question 1: (20 marks) What is the "balance of payments account" of a country? Describe the 3 parts of the account and list the items recorded in each part. Download and print the current A/C balance as a % of GDP for the period...", проверено и соответствует описанию. В случае обоснованных претензий мы гарантируем возврат денег в течение 24 часов.

Утром сдавать, а работа еще не написана?

Через 30 секунд после оплаты вы скачаете эту работу!

Сегодня уже купили 70 работ. Успей и ты забрать свою пока это не сделал кто-то другой!

ПРЕДЫДУЩАЯ РАБОТА

Выполнить задание 1. Двухпроводная воздушная линия расположена над землей в поле грозового облака напряженностью Е0. Между проводами приложено...

СЛЕДУЮЩАЯ РАБОТА

Оценка экономической информации